China Shines: Insights into Culture and Society

Explore the vibrant narratives and emerging trends from China.

Renters Insurance: What Your Landlord Isn't Telling You

Unlock the secrets your landlord won't share! Discover why renters insurance is a must-have for your peace of mind and financial security.

5 Myths About Renters Insurance Debunked

Myth 1: Renters insurance is too expensive. Many people assume that renters insurance will add a significant cost to their monthly expenses. However, the truth is that renters insurance is often quite affordable, with average premiums ranging from $15 to $30 per month. The peace of mind that comes with knowing your personal belongings are covered in case of theft, fire, or other disasters makes it a small price to pay.

Myth 2: I don’t need renters insurance because my landlord has coverage. It's a common misconception that the landlord's insurance policy covers tenants' personal belongings. In reality, while the landlord's policy generally covers the building itself, it does not extend to the tenants' possessions. As a renter, having your own renters insurance is essential to protect against losses that the landlord's policy does not cover, ensuring that you can recover financially in case of an incident.

Why You Need Renters Insurance Before Signing Your Lease

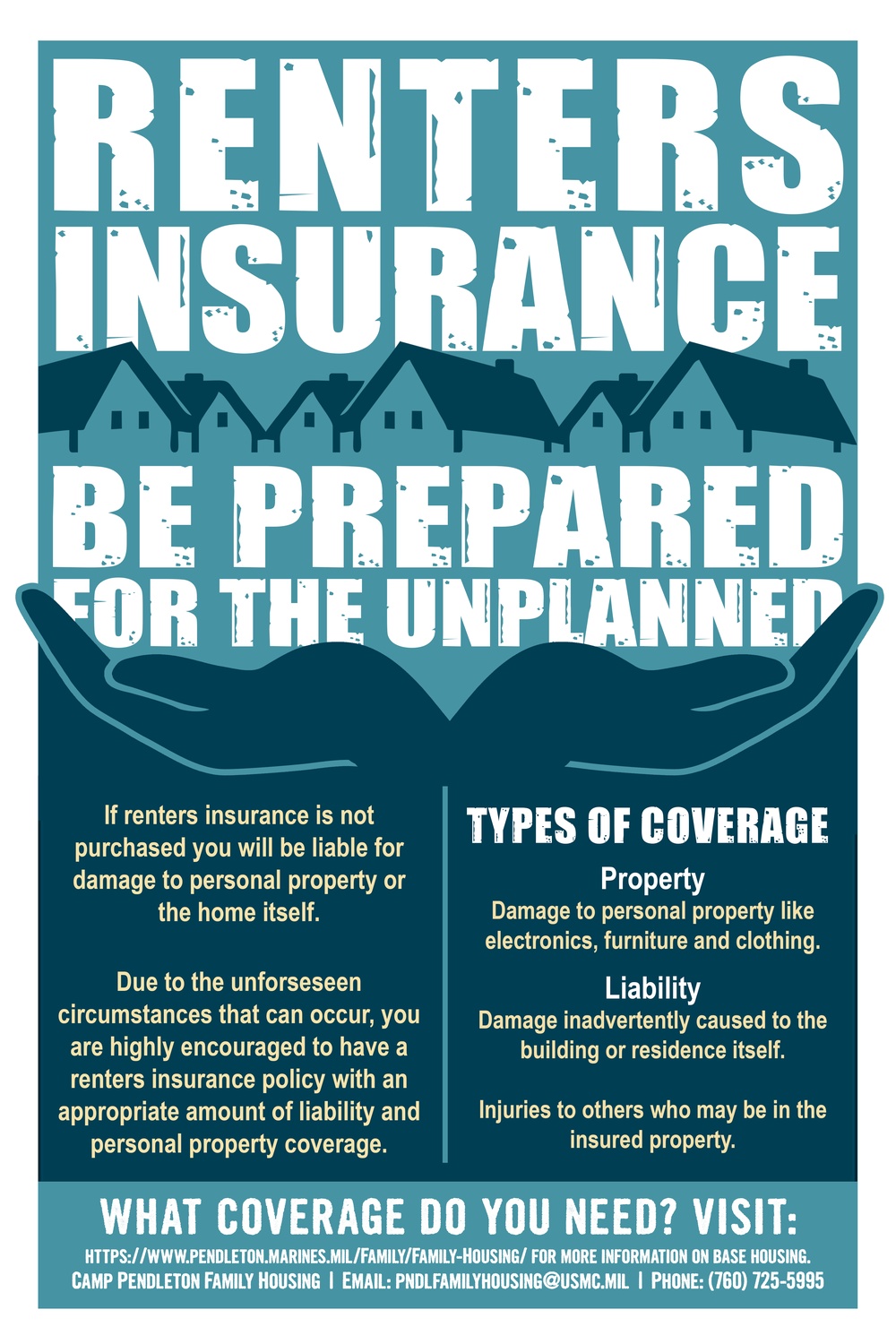

Before you move into your new rental home, it's crucial to consider renters insurance. This type of insurance protects your personal belongings in case of theft, fire, or other unexpected events that could damage your property. By securing renters insurance before signing your lease, you not only safeguard your assets but also gain peace of mind knowing you are protected from potential financial losses. Most landlords may even require proof of renters insurance before allowing you to sign the lease, making it a necessary step in the rental process.

Additionally, renters insurance can provide liability coverage for incidents that may occur in your rental unit. For example, if a guest injures themselves while visiting, you could be held liable for their medical expenses. With renters insurance, you can protect yourself from such unforeseen liabilities. In summary, having renters insurance not only fulfills landlord requirements but also serves as a critical safety net, giving you the confidence to enjoy your new home without the weight of potential risks hanging over your head.

What Does Renters Insurance Actually Cover?

Renters insurance provides essential financial protection for tenants, covering a range of personal belongings against unforeseen events. Typically, it safeguards items such as furniture, electronics, clothing, and valuable personal possessions from risks like theft, fire, or vandalism. In most policies, coverage may extend to both the actual cash value and replacement costs, ensuring that you can recover the value of your belongings or replace them if necessary.

In addition to protecting your personal items, renters insurance also includes liability coverage. This aspect of the policy is crucial as it shields you from potential legal claims if someone gets injured in your rented property. For example, if a visitor slips and falls, your renters insurance can help cover medical expenses and legal fees. Furthermore, some policies might offer additional living expenses coverage, helping you with costs if you need to temporarily relocate due to a covered loss, such as extensive fire damage.