China Shines: Insights into Culture and Society

Explore the vibrant narratives and emerging trends from China.

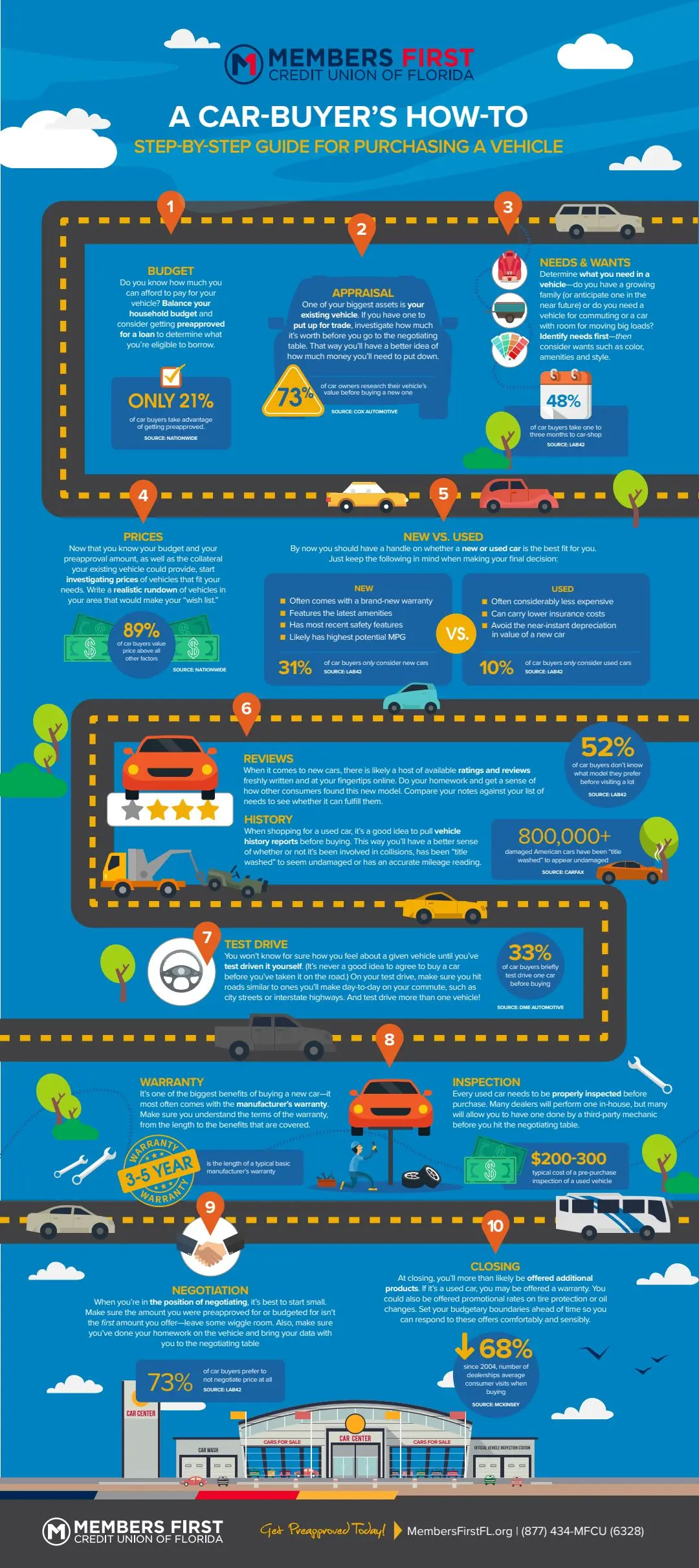

Avoiding Buyer’s Remorse on Wheels

Stop second-guessing your ride! Discover top tips to avoid buyer's remorse and make your next vehicle purchase a joy, not a regret.

Top 5 Tips to Prevent Buyer’s Remorse When Purchasing a Vehicle

Purchasing a vehicle is a significant investment, and to avoid buyer’s remorse, it's essential to be well-prepared. Here are the top 5 tips to ensure that you're happy with your purchase:

- Research Your Options: Start by researching different makes and models that fit your budget. Websites like Edmunds provide comprehensive reviews and comparisons to help you make an informed choice.

- Set a Budget: Determine a realistic budget before you start shopping. Be sure to include expenses like insurance, taxes, and maintenance costs to avoid financial stress later.

3. Test Drive: Always take the vehicle for a test drive. This not only allows you to assess comfort and performance, but it also helps you determine if it truly meets your needs. For more insights on the test driving process, check out Consumer Reports.

- Check the Vehicle History: If you're purchasing a used car, obtaining a vehicle history report from services like Carfax can reveal crucial information about the car's past.

- Consider Timing: Timing your purchase can also influence your satisfaction. End-of-month or end-of-year sales often provide better deals, giving you a sense of accomplishment instead of regret.

The Ultimate Guide to Test Driving: Key Steps to Avoid Buyer’s Regret

Test driving a vehicle is a crucial step in the car-buying process. It provides you with the opportunity to assess whether a car suits your needs and preferences. To ensure you make an informed decision and avoid buyer’s regret, follow these key steps:

- Research the models you’re interested in before visiting dealerships; this will help you zero in on your options and understand the market.

- Prepare a checklist of features and questions to discuss during the test drive, ensuring you cover everything that matters to you.

- Consider scheduling your test drive during off-peak hours for a better experience with fewer distractions.

For additional insights on preparing for a test drive, you can check out Edmunds’ guide.

During the test drive, take your time to evaluate the car thoroughly. Pay attention to how it handles, accelerates, and brakes. It’s essential to test it in various conditions—urban settings, highways, and even rougher roads if possible, to get a well-rounded experience. Document your impressions and any concerns you have in a notepad or on your phone.

To learn more about what to look for during a test drive, visit Consumer Reports for expert tips.

Is This Car Right for You? Questions to Avoid Buyer’s Remorse on Wheels

Purchasing a car is not just about selecting a model that looks good—it's a significant investment that requires careful consideration. To prevent buyer's remorse, start by asking yourself key questions. Will this car fit your lifestyle? Consider factors like fuel efficiency, trunk space, and maintenance costs. For instance, if you have a growing family, a spacious SUV may be ideal, while a compact car may suit a single urban dweller best. For more insights on assessing your needs, check out this guide on choosing the right car.

It’s also essential to evaluate your financial situation. Ask yourself if you can comfortably afford the monthly payments and insurance costs. A good rule of thumb is to ensure that your total car expenses do not exceed 15% of your monthly income. To see how much you can afford, consider using a budgeting tool or calculator available on sites like NerdWallet. By answering these essential questions, you can take proactive steps to ensure your new car aligns with your financial and personal needs, ultimately reducing the chances of buyer's remorse.