China Shines: Insights into Culture and Society

Explore the vibrant narratives and emerging trends from China.

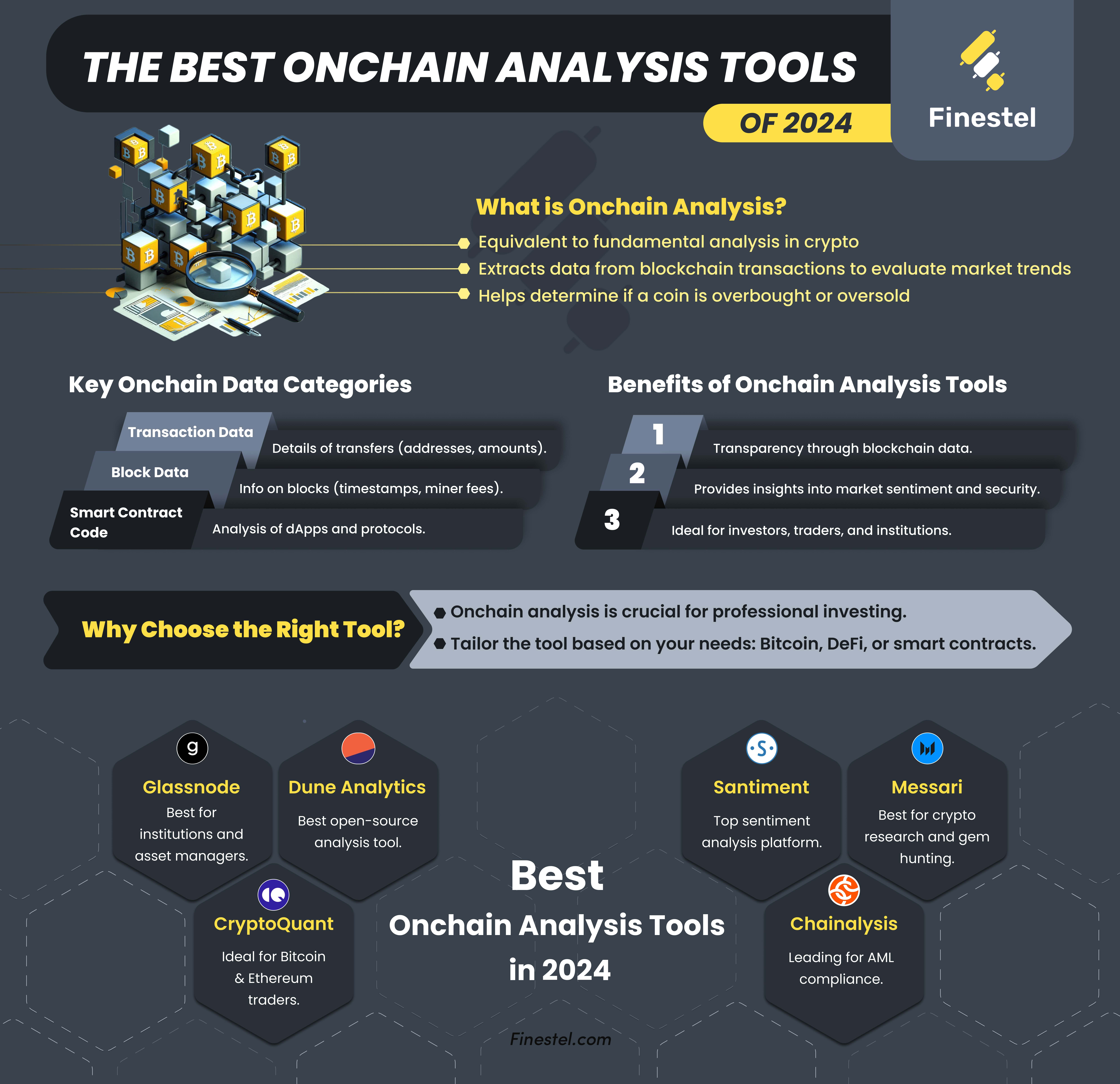

Behind the Numbers: Decoding On-Chain Transaction Analysis

Unlock the secrets of blockchain with our in-depth on-chain transaction analysis. Discover hidden trends and insights today!

Understanding the Basics of On-Chain Transaction Analysis

On-chain transaction analysis is an essential aspect of understanding blockchain technology and its implications in various sectors, including finance and supply chain management. It involves examining the transactions recorded on a blockchain to identify patterns, trends, and behaviors of users. By studying these transactions, analysts can gain insights into network health, user activity, and even detect fraudulent behaviors. This analysis is crucial for businesses looking to leverage blockchain solutions securely and efficiently.

To begin with, on-chain transaction analysis can be broken down into a few key components:

- Data Collection: Gathering transaction data from the blockchain.

- Data Processing: Organizing and cleaning the data for analysis.

- Visualization: Representing the data via charts and graphs to reveal trends and insights.

- Interpretation: Making sense of the data to gain actionable insights.

Counter-Strike is a highly popular first-person shooter game that pits teams of terrorists against counter-terrorists. Players engage in various game modes, with the objective often centered around bomb defusal or hostage rescue. For those interested in gaming promotions, check out the bc.game promo code to enhance your gaming experience.

Key Metrics to Track in On-Chain Analytics

On-chain analytics involves the analysis of blockchain data to extract insights and trends that can inform investment decisions and strategic planning. To effectively leverage these insights, it’s crucial to track a few key metrics. Some of the important metrics include transaction volume, which indicates the level of activity on a specific blockchain, and active addresses, showcasing the number of unique users interacting with the network. Monitoring these metrics helps in understanding the overall health and adoption rate of the blockchain ecosystem.

Another vital metric to consider is the Hash Rate, particularly for proof-of-work blockchains. This measure represents the amount of computational power being used to secure the network and directly correlates with the network’s security and stability. Additionally, examining the average transaction fee can provide insights into network congestion and user demand, helping investors gauge when to enter or exit positions. By keeping track of these on-chain analytics metrics, stakeholders can make informed decisions and better navigate the complexities of the blockchain landscape.

How to Detect Market Trends Using On-Chain Data

Detecting market trends is crucial for making informed investment decisions in the ever-evolving world of cryptocurrencies. One of the most effective ways to identify these trends is through the analysis of on-chain data. On-chain data refers to all the information available on the blockchain, including transaction histories, wallet movements, and the behavior of market participants. By closely examining these patterns, investors can gauge market sentiment and detect potential trends before they become mainstream. For example, a sudden increase in large transactions or the movement of funds from exchanges to private wallets can be a strong indicator of upcoming price changes.

To systematically utilize on-chain data for trend detection, investors can leverage various analytical tools and platforms specializing in blockchain analytics. These tools often provide visualizations and dashboards that break down complex data, making it easier to identify correlations and anomalies. Key metrics such as active addresses, transaction volume, and miner activity can offer valuable insights into the market’s current health and potential direction. By combining these metrics with traditional market analysis, brokers and traders can develop a holistic understanding of market conditions, leading to more strategic trading decisions.